Next Phase Advisors Announces Launch of Safe Bucket Blueprint™ to Help Retirees Create Reliable Income Amid Market Uncertainty

Founder of Next Phase Advisors Introduces “Safe Bucket” Strategy to Help Retirees Create Reliable Income in Uncertain Markets

/EIN News/ -- HUNTSVILLE, AL, June 16, 2025 (GLOBE NEWSWIRE) -- Next Phase Advisors, a Huntsville-based retirement planning firm led by founder and retirement income specialist Jeremiah Nolen, announced the official launch of its flagship retirement income planning framework, the Safe Bucket Blueprint™. Designed specifically for today’s retirement landscape, the blueprint provides a structured approach to turning savings into a reliable income stream, offering peace of mind for retirees and pre-retirees navigating volatile markets.

Jeremiah Nolen, CRPC®, NSSA® and Retirement Income Specialist, helps pre-retirees and retirees

turn savings into sustainable income through his Safe Bucket blueprint.

With fewer Americans receiving traditional pensions and rising concerns about outliving retirement savings, the Safe Bucket Blueprint™ arrives at a critical time. This innovative approach helps clients transition from saving to spending by establishing personalized, protected income streams that support essential expenses, while allowing other assets to continue growing.

“Retirement planning today is no longer just about how much you’ve saved. It’s about how you’ll convert that savings into a sustainable income stream,” said Nolen. “Too many people approach retirement like day traders, when what they truly need is consistent, long-term income planning.”

A Modern Income Planning Solution

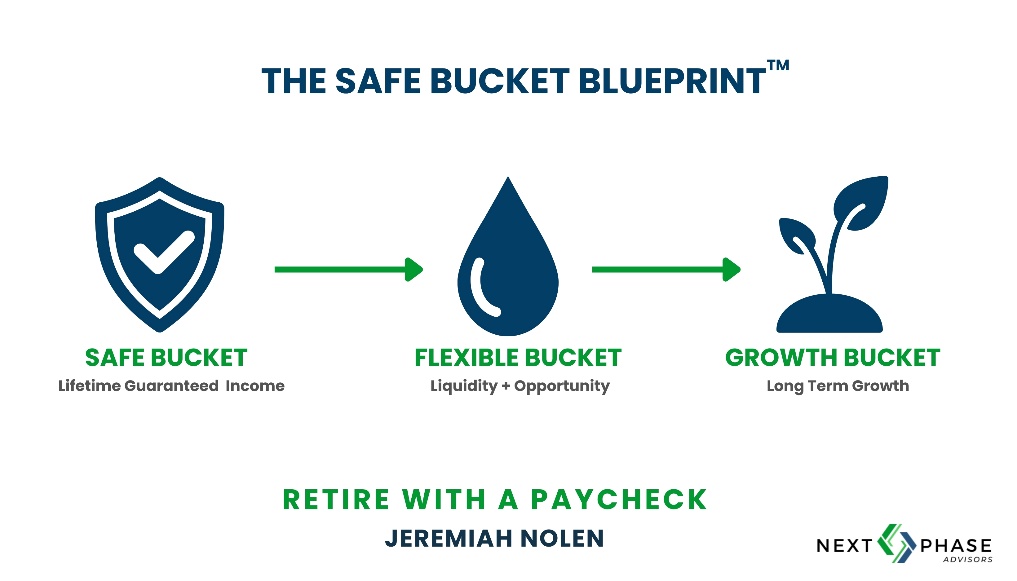

Unlike traditional retirement strategies focused solely on accumulation, the Safe Bucket Blueprint™ shifts focus to the decumulation phase on how retirees withdraw and use their savings over a 20- to 30-year period. The blueprint uses a multi-bucket strategy that segments assets into:

- Protected Income Bucket – covering non-negotiable living expenses with sources such as annuities or guaranteed instruments;

- Flexible Access Bucket – for medium-term needs and unexpected expenses;

- Growth Bucket – designed for discretionary spending, market participation, and legacy planning.

This framework is customizable, not product-specific, and is used by Nolen and his advisory team to create income plans tailored to each client’s lifestyle and goals.

Thinking Like a Pension Manager

At the core of the Safe Bucket Blueprint™ is a philosophy borrowed from institutional pension planning: match future liabilities with reliable income. Nolen encourages retirees to think more like pension managers, who focus on sustainable payouts, rather than day traders who chase short-term gains.

“Market timing is a risky game in retirement,” Nolen emphasized. “What retirees need is dependable income they can count on, regardless of market swings. Our blueprint ensures essential needs are covered, freeing clients to invest the rest with intention, not fear.”

Responding to Industry Demand

Industry research highlights the need for structured income planning:

- A 2023 Transamerica study found 57% of pre-retirees lack a formal income plan.

- The Employee Benefit Research Institute reported that only one-third of retirees receive guaranteed income beyond Social Security.

- According to Allianz Life, the top fear among retirees remains outliving their savings.

These statistics underscore the importance of tools like the Safe Bucket Blueprint™, especially for those approaching retirement without a clear income strategy.

Who Should Consider the Blueprint

Nolen recommends the Safe Bucket Blueprint™ for individuals within five to ten years of retirement, especially those:

- Concerned about market volatility and income predictability;

- Transitioning from 401(k) or IRA accumulation into distribution;

- Without access to a pension or other guaranteed income source.

“This is not just a new product—it’s a new way of thinking about retirement,” Nolen added. “The earlier you begin planning your income strategy, the more options and flexibility you’ll have to retire confidently.”

Complimentary Strategy Sessions Available

To mark the launch, Next Phase Advisors is offering complimentary strategy sessions to help retirees and pre-retirees explore how the Safe Bucket Blueprint™ can be customized to their needs. These sessions include a personalized income map and insights into potential gaps or inefficiencies in their current retirement plan.

Interested individuals can visit www.nextphaseadvisor.com to learn more or to schedule their session.

About Jeremiah Nolen & Next Phase Advisors

Jeremiah Nolen, CRPC®, NSSA®, is the founder of Next Phase Advisors, a firm specializing in retirement income planning based in Huntsville, Alabama. With a mission to help clients transition from accumulation to income with clarity and confidence, Nolen and his team provide comprehensive, education-based guidance through personalized strategies such as the Safe Bucket Blueprint™.

The Safe Bucket Blueprint™ helps retirees allocate assets into protected income, flexible access, and

long-term growth buckets.

Media Contact:

Company: Next Phase Advisors

Contact: Jeremiah Nolen

Email: jeremiah@nextphaseadvisor.com

Phone: 256-841-7727

Website: www.nextphaseadvisor.com

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release