Latest Trends in New Crop Protection Generics Market | Market Share USD 93.5 Billion by 2031 | DataM Intelligence

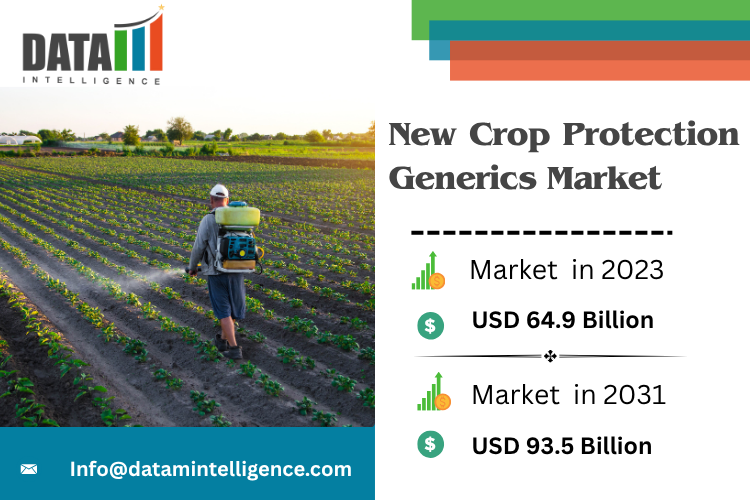

New Crop Protection Generics Market

The New Crop Protection Generics Market is growing rapidly, driven by rising demand for affordable, effective pest control solutions worldwide through 2031.

AUSTIN, TX, UNITED STATES, May 29, 2025 /EINPresswire.com/ -- New Crop Protection Generics Market Report – 2031 Outlook

The market for New Crop Protection Generics Market Size was valued at USD 64.9 billion in 2023 and is expected to expand to USD 93.5 billion by 2031, growing at a compound annual growth rate (CAGR) of 4.6% between 2024 and 2031.

To Download Sample Report: https://www.datamintelligence.com/download-sample/new-crop-protection-generics-market

The global market for crop protection generics is undergoing a strong transformation, responding to both economic and environmental pressures. Farmers and agribusinesses are shifting their focus from branded products to more affordable and reliable generic alternatives. As the world moves toward more sustainable farming practices, the importance of generics in crop protection continues to rise. These generic solutions offer similar efficacy to their branded counterparts but at a fraction of the cost, making them increasingly attractive for both smallholder farmers and large-scale agronomists.

Regional Outlook

Asia-Pacific

Asia-Pacific leads the charge, not just in consumption, but also in manufacturing of generics. Countries like India and China are becoming global hubs for crop protection manufacturing, taking advantage of lower production costs and a skilled workforce. Additionally, growing awareness among farmers about integrated pest management and sustainable farming is further pushing demand for affordable crop protection options.

North America

In North America, the focus is shifting from innovation-heavy branded products to strategic adoption of generics, particularly in the Midwest, where large-scale farming requires massive volumes of crop protection products. Farmers are becoming more price-sensitive, especially with the fluctuating prices of commodities like corn and soybeans. This has opened the door for generics to gain significant market share.

Europe

Europe presents a mixed picture. While regulatory hurdles are high, especially regarding chemical residue limits, the push toward eco-friendly and sustainable farming methods has opened up opportunities for bio-based generics and less toxic alternatives. Western Europe, especially Germany and France, is seeing increased adoption of generics, although at a slower pace than Asia-Pacific.

Most Leading Companies

UPL

BASF

Nufarm

ADAMA

FMC Corporation

Bayer AG

Albaugh LLC

AMVAC Chemical Corporation

Wynca Group

Sumitomo Chemical Co., Ltd.

Coromandel International Limited

Syngenta

Market Segmentation:

By Type: Herbicide, Fungicide, Insecticide, Insect Growth Regulators, Others

By Mode of Application: Foliar Spray, Seed Treatment, Soil Treatment, Post-harvest, Others

By Crop Type: Grains & Cereals, Oilseeds & Pulses, Fruits & Vegetables, Commercial Crops, Others

By Formulation: Liquid, Granular, Powder, Emulsifiable Concentrates

By Distribution Channel: Retailers, Distributors, E-commerce, Cooperative Societies

Product Innovation and Market Trends

Innovation in the generics segment is becoming more sophisticated. While generics are traditionally known for being replicas of branded products, modern generic developers are now investing in formulation improvements, such as controlled-release technologies, water-soluble granules, and eco-friendly carriers.

Farmers today expect more than just affordability—they want ease of application, minimal residue, and compatibility with sustainable farming certifications. To meet these expectations, generic manufacturers are enhancing product performance while maintaining cost advantages.

Moreover, digital agriculture is influencing product distribution and usage. From drone-based spraying systems to AI-powered pest prediction models, crop protection products are now part of broader smart farming ecosystems, and generic players are adapting accordingly.

Latest News: USA

In the United States, the market is adjusting to tighter farm budgets and rising operational costs. Farmers are being more selective about the products they use, often opting for generics over branded chemicals due to affordability and comparable performance. This has led to a visible shift in procurement trends at the dealer and cooperative levels.

In 2025, agricultural cooperatives across key states like Iowa, Illinois, and Nebraska have reported a noticeable rise in generic herbicide purchases. Retailers are also expanding their inventory of generic products, supported by favorable distribution margins and rising demand from local growers.

However, this shift is causing ripples across the industry. Major agrochemical firms are facing reduced sales volumes for some branded products, prompting them to either slash prices or introduce their own in-house generic lines to remain competitive.

Latest News: Japan

In Japan, where agriculture tends to be smaller in scale but highly specialized, the adoption of generics has seen a recent uptick. Japanese farmers are traditionally cautious about switching products, valuing quality and traceability. However, with government support for cost-saving measures in agriculture, many growers are now trialing generics under controlled conditions.

In early 2025, several local agricultural cooperatives introduced new generic insecticides and fungicides for rice and fruit crops, offering them at a discount compared to branded equivalents. The early response has been positive, especially among younger, tech-savvy farmers who are open to experimenting with cost-effective alternatives.

Additionally, domestic chemical companies in Japan are forming joint ventures with foreign generic manufacturers to bring high-quality yet affordable crop protection products to the market. These collaborations aim to balance Japanese quality standards with the price competitiveness of generic offerings.

Conclusion

The crop protection generics market is set to grow steadily in 2025 and beyond, driven by a blend of economic necessity and regulatory evolution. As farmers worldwide look for ways to protect yields without breaking the bank, generics are becoming an indispensable part of modern agriculture. With continued product innovation, regional collaboration, and a growing focus on sustainability, the generic segment is no longer just a cheaper alternative it is becoming a strategic choice in global crop protection.

Stay informed with the latest industry insights—start your subscription now: https://www.datamintelligence.com/reports-subscription

Most Trending Recent Related Reports:

Crop Protection Chemicals Market Share Analysis By 2031

Oilseed Crop Protection Chemicals Market Size By 2031

Sai Kiran

DataM Intelligence 4Market Research

+1 877-441-4866

email us here

Visit us on social media:

LinkedIn

X

Distribution channels: Agriculture, Farming & Forestry Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release