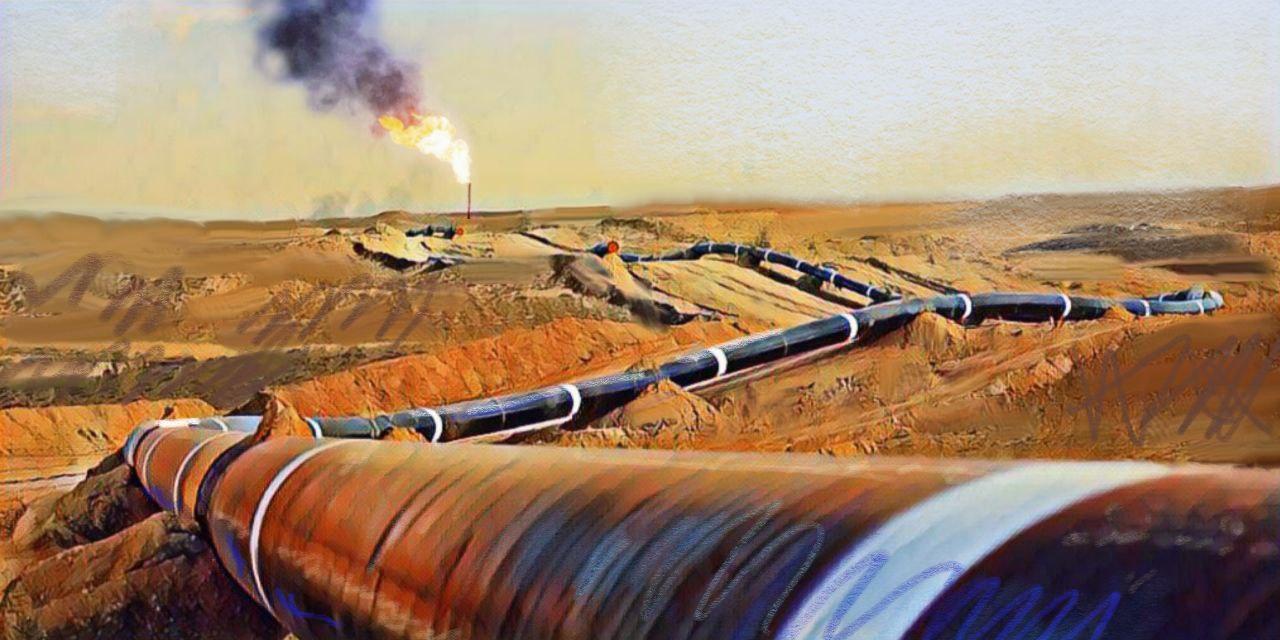

Turkmenistan has the fourth largest reserves of natural gas in the world, but the country has found it difficult to export substantial volumes. Lack of export pipelines are one of the problems and it seemed Turkmenistan had partially solved this dilemma by arranging gas swap deals.

Unfortunately for Turkmenistan, these deals involve Iran as the key country, and the Israeli-Iran conflict sheds new doubt on the ability of Iran to fulfill its part in the swap arrangements.

So Close

Turkmenistan signed a deal to supply 10 billion cubic meters (bcm) of gas annually to Iraq in late October 2024. It was the first major gas export deal Turkmenistan had signed in nearly two decades.

That last big agreement was signed with China in 2006. It involved building four gas pipelines from Turkmenistan to China to eventually carry a combined 85 bcm of gas, 65 bcm of which would be Turkmen gas. Since the pipelines cross through Uzbekistan and Kazakhstan, both of those countries are allotted 10 bcm each of the capacity for their gas exports.

The fourth branch that would have carried 30 bcm of Turkmen gas has not been built, leaving Turkmen gas exports to China averaging 35 bcm per year.

At the moment, China is the only major customer for Turkmen gas. The second largest buyer of Turkmen gas is Uzbekistan, which only purchases about 2 bcm.

Not even 20 years ago, Russia was purchasing more than 40 bcm of Turkmen gas, but by 2023 that had dwindled to 5.5 bcm, still leaving Russia as the second largest buyer of Turkmen gas. In July 2024, after negotiations over price broke down, the two parties chose not to renew that contract.

That made the agreement with Iraq all the more important for Turkmenistan. However, there are no pipelines connecting the two countries.

Yet So Far

The Turkmen-Iraqi agreement calls for Turkmenistan to ship 10 bcm of gas to Iran, with Iran then sending 10 bcm of its gas to Iraq. Iran needs gas for its northern regions that are not connected to the domestic pipeline network that sources gas from the fields of in the south of the country.

Turkmenistan has two pipelines to export gas to Iran. Both were built after independence in 1991, and could carry up to a combined 20 bcm. Since January 2017, when the Turkmen government made good on a threat to cut off Iran over unpaid bills for gas, almost no gas has been shipped through these pipelines.

The first task is to perform maintenance, repairs, and upgrades on these pipelines so that Turkmenistan can physically send 10 bcm of gas to Iran.

The Iranian pipeline to Iraq is functional. Iran was exporting gas to Iraq, but international sanctions on Iran hindered Iraq’s ability to pay for that gas.

Prior to the agreement with Iraq, Turkmenistan signed a contract in early July 2024 with Iranian officials for the transfer of gas.

It is unclear how far along Turkmenistan is in performing its pipeline maintenance in preparation for resuming gas exports to northern Iran, but work is likely now on hold due to the uncertainty surrounding Iran’s conflict with Israel.

The involvement of Iran in the Turkmen-Iraq gas swap arrangement had promised additional gains for Turkmenistan. According to the Turkmen-Iranian agreement of July 2024, “Iranian companies will construct a new 125-kilometer gas pipeline along with three gas pressure booster stations in Turkmenistan aimed at boosting annual shipments of gas to Iran to 40 bcm.”

That would not only double Turkmenistan’s potential export capacity to Iran but also double Turkmenistan’s current total gas exports.

Again, the contract is at risk due to the Israel-Iran conflict.

It was never mentioned which Iranian companies would be working in Turkmenistan, but it appears that Iran’s first priority once the fighting with Israel ends will be to repair damaged infrastructure inside the country. Iran’s ability to pay for 30 bcm of gas will also be a question, as Iranian state funds are directed toward the restoration of infrastructure.

At the very least, the Turkmen-Iraq gas swap seems headed for delays.

In the meantime, for about a decade, Turkmenistan has also had an on-again, off-again gas swap agreement with Azerbaijan via Iran. It is for a substantially smaller amount, only about 1 bcm, but the situation in Iran might shut down the deal with Azerbaijan too, at least temporarily.

Minus 70 in One Week

Setbacks to Turkmenistan’s plans to export gas were not confined to the situation with Iran.

Turkmen President Serdar Berdimuhamedov was in Kazakhstan’s capital, Astana on June 17 for the C5+1 summit with the other Central Asian presidents and Xi Jinping of China. Berdimuhamedov met separately with Xi, hoping for some sign that work on Line D of the pipeline network leading from Turkmenistan to China might start soon. According to the Chinese news agency Xinhua, Xi only spoke vaguely about boosting natural gas cooperation.

When Berdimuhamedov visited China in January 2023, a joint statement with Xi at least mentioned the need to “accelerate… construction of Line D of the Turkmenistan-China gas pipeline.” No construction has been done on Line D since that statement, and it seems no progress was reached during the meeting between Xi and Berdimuhamedov in Astana.

So, the news from Iran is especially crushing to Turkmenistan’s gas export aspirations. No additional 40 bcm to Iran, including the 10 bcm for Iraq, anytime soon, and no extra 30 bcm to China.